Internet banking has actually been around for quite a long time now and there is no doubt that it has made banking a lot extra reliable and easy. Fostering of internet banking remains to expand day by day. Research shows that the variety of deals happening via the internet is expected to go across 33 billion by 2012. The number of on-line deals is expanding at a rate of nearly 13%, a lot higher than that for any other channel. By 2013, financial institutions expect virtually 20% of sales to be made via this channel. Financial through the web is certainly extra affordable as well as there is a sector of clients who like the comfort and very easy access that it provides. Personal financial administration tools have actually equipped consumer and also instructed them to handle their financial resources themselves.

While all this holds true, there is another channel whose value can not be understated, and that is the branch. In a current global research study of retail banking, participants ranked the branch as well as the Internet as one of the most essential channels. Throughout the years, financial institutions have actually attempted to move consumers away from the branch in the direction of a number of self-service channels, also offering them incentives to do so. Regardless of these efforts, the branch continues to be the channel of choice for a substantial proportion of consumers. There are several reasons for this, not the least of which is psychological convenience. The physical environs of the branch and also the schedule of team and advisers motivate trust and also confidence in financial customers. When they stroll into a branch, they are sure of locating somebody to address their questions; they take service for granted. This feeling of confidence is so crucial to them that they don't mind taking the trouble of visiting the branch or waiting in line to be offered.

Not surprisingly, one more recent research study revealed that customer engagement in retail financial - a significant determinant of quality of experience - was driven more by psychological, as opposed to practical elements. At the top of this checklist was consumers require to be valued, adhered to by their understanding of the engagement level of bank employees. Put simply, consumers wanted bank employees to show them that they valued their company, and when required, go the extra mile to accomplish their expectations.

Another analysis said that retail financial brands should be emotionally lined up with their consumers to win them over. This suggests that financial institutions must attempt to comprehend their clients requires better by asking relevant inquiries, paying attention thoroughly and also providing a sympathetic ear to genuine troubles.

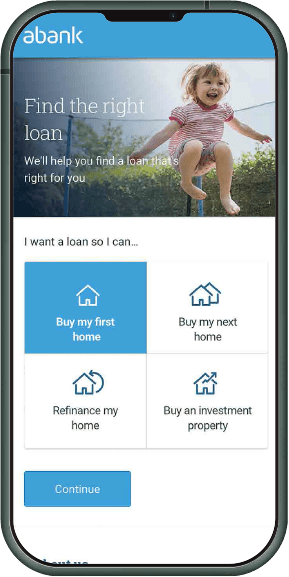

Relocating from the topic of motorists to barriers, past studies have actually repeatedly shown that concern relating to security is just one of the greatest obstacles to Internet banking fostering. While this has certainly boiled down in the last few years with protection systems ending up being extra durable, the reality stays that people - also Internet banking customers - are not at ease sharing sensitive monetary details over a internet site, and also as a result limit their activity to basic deals. One more reason why customers don't do even more through Electronic banking is that the majority of banks do not supply consultatory services over this network, more restricting its role. On the other hand, the branch has constantly been the best option for clients seeking to make a essential monetary decision calling for consultatory input, such as availing a home loan or intending an financial investment profile.

These realities explain why, in spite of the benefit and also availability of Internet banking and various other online networks, many consumers still choose the branch as a channel for banking. And so, presumably that document verification ai replicating the branch experience through other networks such as the Web, is a good approach that would certainly go a long way in supplying favorable customer experience. Fortunately is that banks can, with some effort, replicate the branch experience - which has been successful thus far, and continues to maintain - in various other networks, including the Web.